Currency Hedging (FX): Developing an Optimal Strategy for Corporates

Navigating FX Risk in Uncertain Times: A Guide for Corporate Treasurers

January 10, 2025

In a year where currency markets have seen unusually low volatility, 2025 is shaping up to be a different story. With divergent monetary policies, fluctuating GDP growth rates, and shifting geopolitical dynamics, corporate treasurers face a more challenging FX landscape.

How can organizations strike the right balance between risk, cost, and opportunity in such an environment? This article explores the tools and strategies that can empower treasurers to craft an optimal FX hedging policy—one that leverages data-driven insights to navigate uncertainty and enhance financial resilience.

Why Focus on FX Risk Management Now?

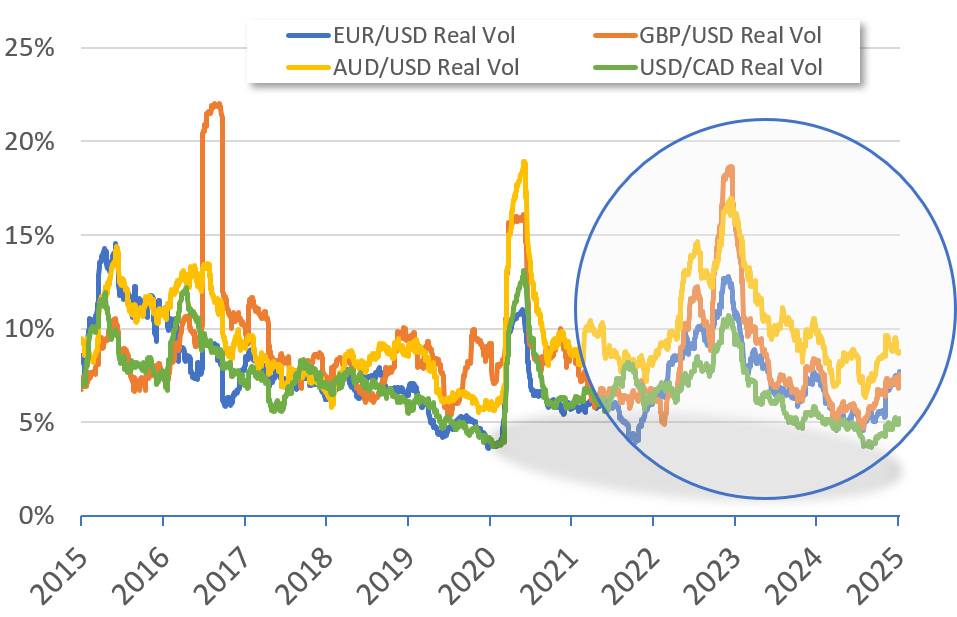

In the past 12 months, currency volatility has been remarkably low, particularly among major currency pairs. For example, during 2024 the EUR/USD has traded within a narrow range of 1.0334 to 1.1214, representing a deviation of only +/-4.1% from the midpoint of the range. Similarly, the GBP/USD (1.2298-1.3436, +/-4.4%), USD/CAD (1.3228-1.4468, +/-4.3%), and USD/CNY (7.0109-7.2996, +/-2%) have also exhibited constrained movement. These figures are notably modest when compared to the volatility seen over the past decade, as one can easily appreciate from the chart on the right, illustrating the realized volatility (rolling quarters) for four currency pairs over the past decade.

The graph shows the trend of volatility achieved by four currency pairs over the last ten years: note how 2024 recorded rather low values compared to the period considered. Source: elaboration by Studio Bellanti

The year to come...

However, 2025 is shaping up to be a year of significant uncertainty, with events that could disrupt this relative stability in the FX market. Divergent monetary policy actions between Europe, the US, and China, varying GDP growth rates in the US and EU, and geopolitical factors, including potential shifts in international trade policies under a new US administration, all present major risks. These developments underline the importance of a robust FX risk management strategy.

As these factors unfold, the role of the Corporate Treasurer in managing FX risk will become even more critical. The potential for substantial currency fluctuations means that businesses must be equipped to respond with precision and agility. Additionally, as finance increasingly embraces data-driven approaches and advanced statistical methods, this is the ideal moment to introduce a more efficient, data-driven approach for determining the best course of action. This article explores such approach and highlights how treasurers can navigate this evolving landscape.

The Hedge Ratio: How Much to Hedge?

Deciding the extent to which a company’s FX exposure should be hedged is a critical consideration. This involves understanding the company’s gross exposure (the total of long and short positions) and net exposure (the difference between FX revenues and costs, by currency). While having visibility over these figures is essential, predicting future exposures can also be challenging due to uncertainties in revenues and costs caused by market and operational factors.

Moving Beyond the "Hedge a Bit Less" Approach

One common approach involves hedging slightly less than the budgeted exposure to mitigate the risk of over-hedging. While practical, this lacks depth. A more refined method considers:

- Expected Variability of Realized Exposures: Using historical data to estimate possible ranges of future exposures.

- Currency Correlations: Recognize that currency risks sometimes offset each other, or have some “offset” effect between different currencies, such that the overall risk to the company is normally less than the sum of the individual risks considered in isolation.

- Cost of Hedging Instruments: Consider the costs of instruments such as forwards and options, to assess whether or not to increase the coverage ratio.

- Efficient Frontier of Hedging Alternatives: Evaluate alternative combinations of hedging ratios to balance risk, hedging costs, and the opportunity to follow the market when it moves in a favorable direction.

Let's review a Super-Simplified Model

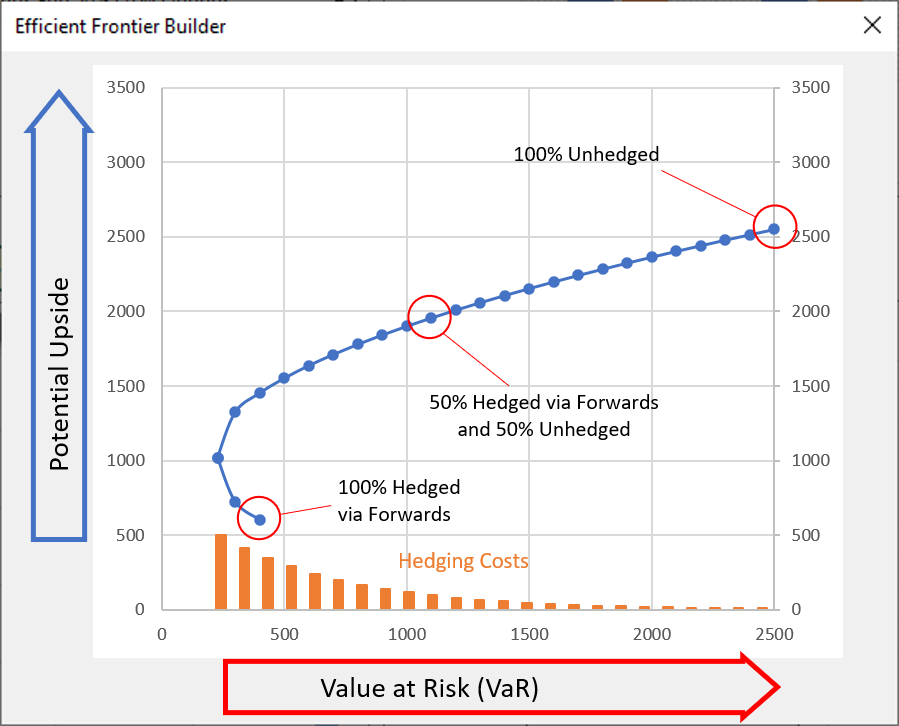

The chart below is an example of analysis conducted over a hypothetical company with a variety of FX exposures. The model has identified about 20 different hedging ratios, using FX Forward only, and for each it returns the expected residual Value-at-Risk, the amount of Hedging Costs and the potential upside in the event of a favorable move in FX prices over the time period considered.

The chart shows the trade-off that exists between reducing risk and participating in favorable movements in FX market prices. Note that this is a purely theoretical example.

Source: elaboration by Studio Bellanti

As expected, hedging 100% via FX forwards eliminates any variability in the final result, but obviously will prevent the company from benefiting from a favorable evolution of market prices. Also, in this example, this is the alternative that attracts more hedging costs. As we reduce the hedging ratio, as expected, the VaR increases and so does the potential upside

Let's build something more advanced

The approach described helps the treasurer to visualize the trade-off between risk and potential upside. On the one hand, very conservative strategies minimize risk, but at the same time prevent us from taking advantage of a favorable market. On the other hand, more dynamic strategies allow us to benefit from favorable market movements, but leave uncovered a more or less significant part of the risk of negative results. By analyzing costs, impact of hedging instruments and currency correlations, treasurers can identify the mix that is most compatible with the company's objectives.

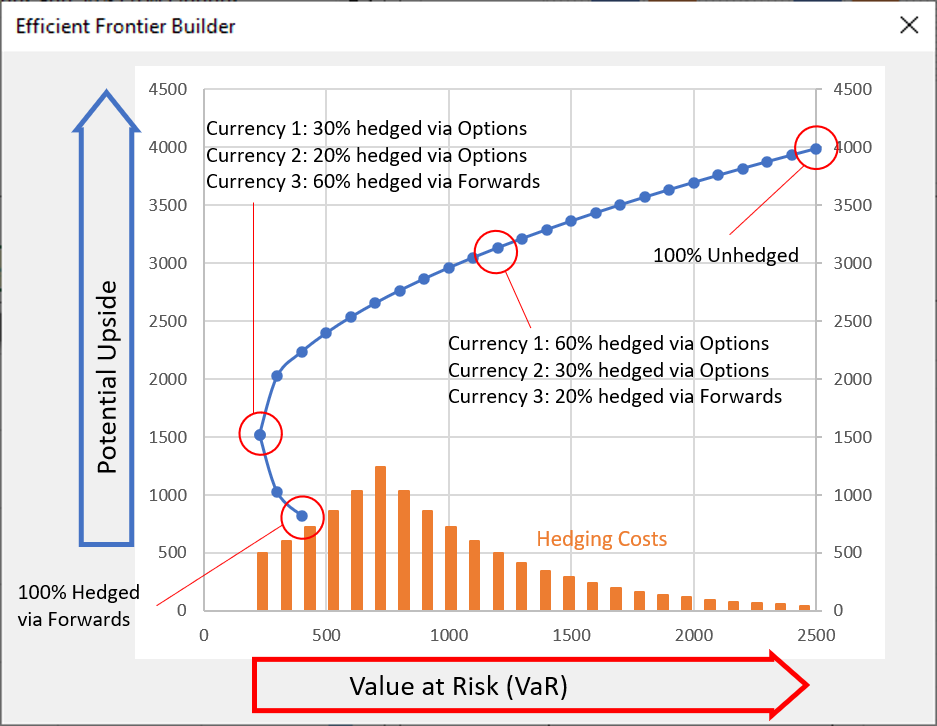

In a more advanced model, the efficient frontier incorporates combinations of FX Forwards and options (or option-based strategies) for each of the currencies that make up the FX exposure pool. Again, this approach allows us to visualize those strategies that offer the opportunity for the greatest potential upside for any given level of residual risk (residual VaR).

Again, the chart shows the trade-off that exists between reducing risk and participating in favorable movements in FX market prices: the difference lies in the greater availability of hedging instruments. Note that this is a purely theoretical example.

Source: elaboration by Studio Bellanti

How about focusing on Hedging Costs instead?

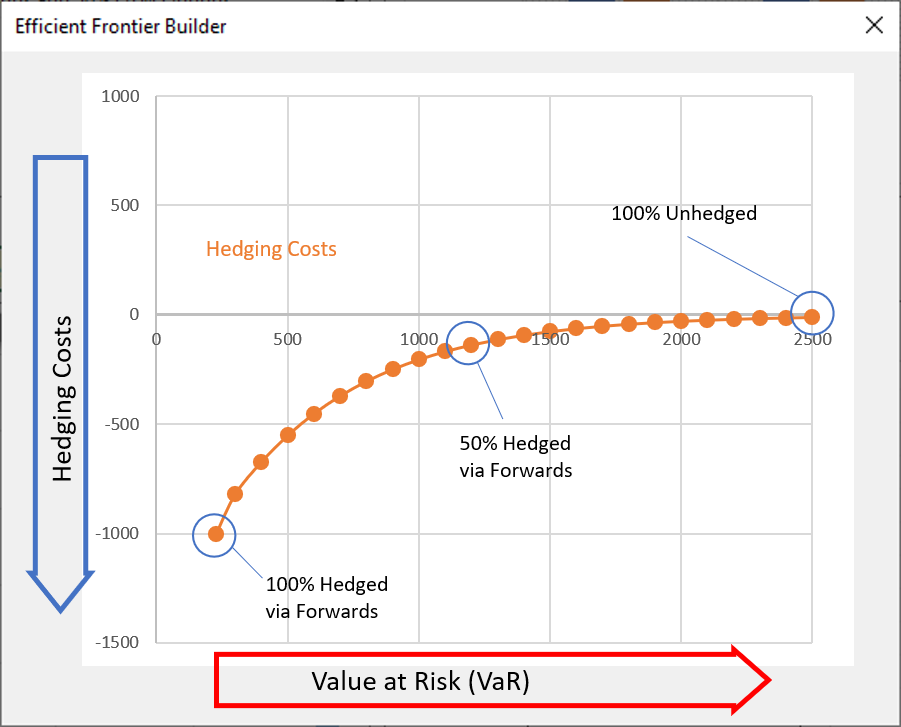

Focusing on maximizing the potential upside for any given level of residual risk can be relevant when the company seeks to take advantage of favorable market price changes to defend its profitability and strengthen its competitive position in the market.

However, there can be other priorities: the Corporate Treasurer may want instead to focus on Hedging Costs, and determine the lowest level of aggregate hedging costs for any given reduction in residual risk of its portfolio of FX exposures. This can be done easily through the same approach but setting the Hedging Costs as the target variable this time.

In the example below, the model shows what is the minimum cost (in terms of hedging costs) necessary to achieve any given level of risk reduction (or residual Value-at-Risk).

In this case, the graph shows the trade-off that exists between risk reduction and hedging costs: Note that this is a purely theoretical example.

Source: elaboration by Studio Bellanti

Practical Implementation: A Holistic Approach

Developing an effective FX hedging strategy requires collaboration across teams. Key steps include:

- Data Collection: Collect historical data and predict future exposures.

- Model Development: Create tools that enable FX risk to be quantified based on realistic assumptions.

- Efficient Frontier Generation: Using advanced statistical, mathematical, and programming techniques to construct an efficient frontier of available alternatives. This process involves analyzing historical exposure data, identifying currency correlations, and calculating possible outcomes for various hedging combinations. The resulting frontier visually represents the optimal strategies for balancing residual risk, hedging costs, and potential gains.

While there is no universal tool to do this, to my knowledge, we have developed a proprietary model that is adaptable to the specific needs of corporates. This model is particularly valuable for companies that manage multiple FX exposures. By adapting to the unique characteristics of each business, we are able to provide useful quantitative inputs to support hedging decisions.

“Since great things cannot be achieved without some danger, businesses should only accept new endeavors when hope is greater than fear.”

Francesco Guicciardini - Political Speeches (1512)

Federico Bellanti

P.I. 13303710969

Business Address: via Montenapoleone 8, 20121 Milano

Registered Address: via Luigi Manzotti 10, 20158 Milano

info@studiobellanti.com

tel.: +39 02 82942 744

Registered at Albo OCF dei Consulenti Finanziari Autonomi (delib. 2520 del 10/07/2024)

Adhering to the Arbitro per le Controversie Finanziarie